Resolve financial strain, get cash loan instantly

In our life, cash loan offer a fast and convenient solution, with a simple application process and efficient approval process making it easy to access funds. Ensuring privacy and offering flexible loan amounts and terms to meet individual needs, cash loans help tackle emergencies and achieve personal and family goals.

Related searches

-

Quick Money Loans

-

Personal Loan Interest Rates Today

-

Fast Cash Now

-

Quick Cash Advance

-

Same Day Cash Advance

-

Cash Loans Online

Cash loans are a quick way to obtain funds, suitable for emergencies or temporary financial needs. The application process is simple, usually requiring no collateral or guarantee, and funds can be obtained quickly.

1. Quick, Convenient, Reliable Solution:

In modern life, sudden financial needs can arise at any time, and cash loans provide a quick, convenient, and reliable solution. Whether it's paying bills, covering medical expenses, or other emergency costs, cash loans can provide instant support.

2. Simple Application Process:

Applying for a cash loan is a straightforward process, without the need for cumbersome paperwork or long waits. Simply fill out a simple application form, submit the necessary documents, and you can get the funds you need. This simple and convenient application process allows you to quickly address your financial needs without delay.

3. Efficient Approval Process:

The approval process for cash loans is efficient and speedy, understanding your urgent need for funds. Approval is typically very fast, ensuring you can get the funds you need in the shortest possible time. This efficient approval process provides you with immediate financial support to deal with various urgent situations.

4. Flexible Loan Amounts and Terms:

Choosing a cash loan gives you access to flexible loan amounts and terms to suit your individual needs and repayment capabilities. Regardless of how much funding you require, you can choose the appropriate loan amount and term based on your circumstances. This flexibility allows you to borrow according to your needs and repay according to your ability.

5. Protection of Customer Privacy and Security:

Cash loan services strictly protect customer personal information and privacy. Your personal information will be kept strictly confidential to ensure your privacy is not compromised. All processes adhere to strict legal regulations, providing transparent and fair loan services, allowing you to borrow with confidence and use funds securely.

6. Addressing Emergency Situations, Easily Solving Financial Challenges:

Cash loans can help you address emergency situations and easily solve various financial challenges. Whether it's unexpected expenses or temporary funding needs, cash loans can provide timely financial support, allowing you to handle various emergencies with ease.

7. Achieving Personal and Family Goals:

Cash loans can help you achieve various personal and family goals. Whether it's paying bills, covering medical expenses, or dealing with unforeseen expenses, cash loans can provide the necessary financial support to help you achieve your goals and aspirations.

7 Key Steps for Publish Your Book in 2025

If you’ve been thinking, “I want to publish my book,” you’re in the right place. Publishing a book in 2025 is easier than ever—but standing out requires strategy. Whether you’re exploring book publishing services or planning to DIY, this guide breaks down the seven essential steps to publish your book successfully. From writing to book marketing services, we’ll cover everything you need to turn your manuscript into a bestselling reality.

The Role of a Finance Adviser in Your Financial Journey

When it comes to managing your personal finances, a Finance Adviser can play a pivotal role. Whether you're saving for retirement, buying a home, or investing in the stock market, having a trusted Finance Adviser by your side is essential. This professional not only helps you understand complex financial concepts but also provides guidance tailored to your specific goals. A skilled Finance Adviser can offer strategies to optimize your financial growth while minimizing risks.

Top Vanguard Funds for Retirement Diversification

When planning for retirement, diversification is a crucial strategy to manage risk and maximize returns. Vanguard, known for its wide range of low-cost mutual funds and ETFs, offers numerous options that can help investors achieve a well-diversified retirement portfolio. Here are some of the top Vanguard funds to consider for retirement diversification.

Mastering Sports Betting: A Comprehensive Guide for US Bettors

In the fast - growing world of American entertainment, sports betting has become a sensation! Since the 2018 Supreme Court ruling, the industry has seen explosive growth, making terms like Sports Betting Reddit, Tvg Online Betting, Best Online Sports Betting, Nfl Betting Picks, Nfl Odd Sharks, and Bet 366 popular among bettors. Whether you’re new to this or a seasoned pro, this guide has got you covered!

The Best Credit Cards For Bad Credit In Peloponnese

Poor credit no longer prevents you from obtaining a respectable credit card. A variety of cards that cater specifically to individuals with credit challenges burst onto the scene in 2024.

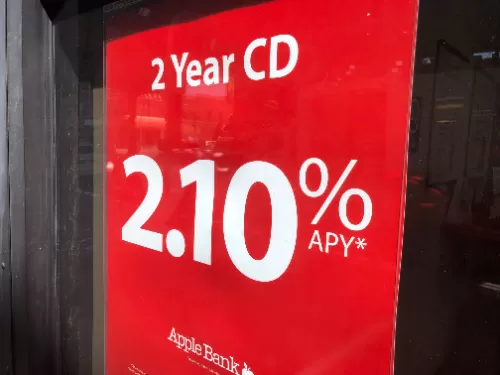

Navigating the Terrain of CD Rates: A Guide to Maximizing Your Savings

In the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

By:

Mia

By:

Mia